Test: linux download

English Original

English paid

French

German

Korean

Japan

Industry 6 - Key Questions

Unlocking the Business Value of Industry 4.0: Part 6

The transition to digital manufacturing is a complex process that requires the right technology partners and a sound assessment of legacy assets, interruption scenarios, and security. However, once achieved, intelligent adaptive manufacturing brings rich opportunities.

Ask yourself these nine key questions as a team, including development, business, strategy, and operational members. Using a simple scale from 1 (yes, or extremely relevant) to 5 (no, or completely irrelevant), calibrate how fully you are maximizing your opportunities.

If you score 4 and 5 for any question, reread these pages to see whether you are prepared for today’s manufacturing potential.

Contact Wind River to discuss your plans for adaptive manufacturing with an intelligent systems expert.

TALK TO AN EXPERTIntelligent Systems

Eight in ten leaders want intelligent systems success in five years' time.

The time to start blueprinting is now.

In our increasingly digital world, the idea of intelligent systems is intrinsically understood but not extensively practiced. For companies in industries such as aerospace and defense, manufacturing, medical technology, energy and utilities, and telecommunications, the challenges lie in determining the right system characteristics for success.

Understanding what to invest in, when to invest in it, and which economic and innovation-based outcomes you are looking to generate will define who wins in the machine economy going forward. Today only 16% of organizations are building from the right blueprint, so learn from them to get ahead of your customers' needs.

SCHEDULE A MEETING WITH A WIND RIVER DIGITAL TRANSFORMATION OFFICER

Our DTOs have the market expertise to accelerate the development of your intelligent systems and deployment of your new business models. Accelerate your transformation.

>> Schedule a Meeting NowSelect your industry to view your intelligent systems blueprint

Explore Wind River Studio

Wind River® Studio is the first cloud-native platform for the development, deployment, operations, and servicing of mission-critical intelligent systems.

Explore NowThirteen key characteristics drive intelligent system success

Knowing when to invest in each characteristic requires a blueprint for building critical infrastructure, delivering core foundational needs, and much more.

What really matters to executives building intelligent systems?

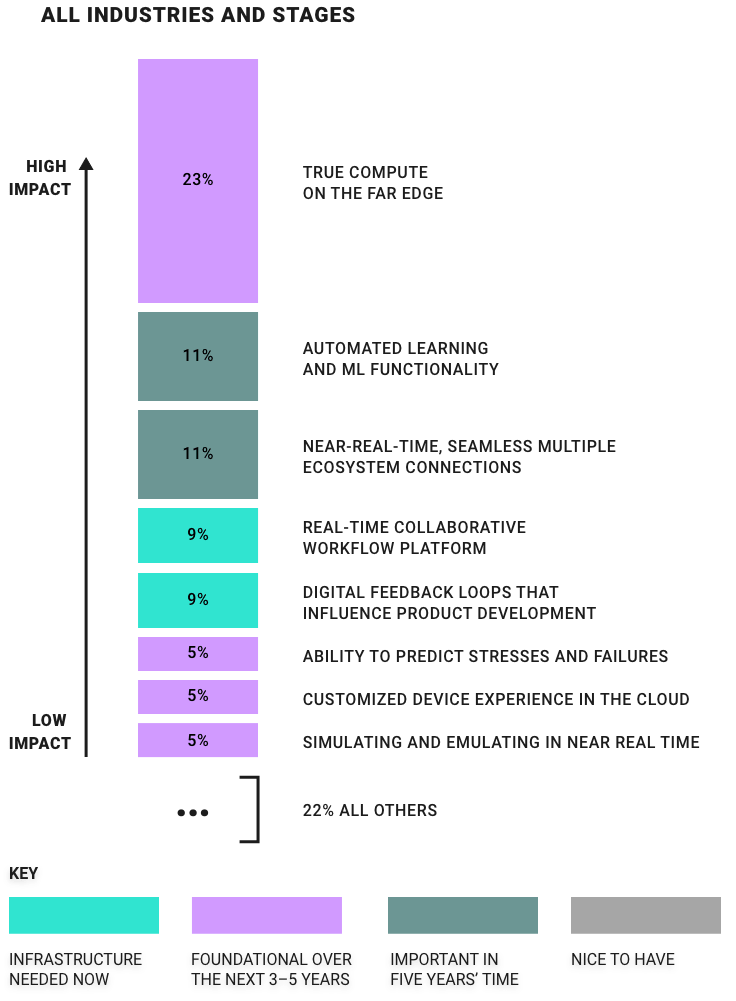

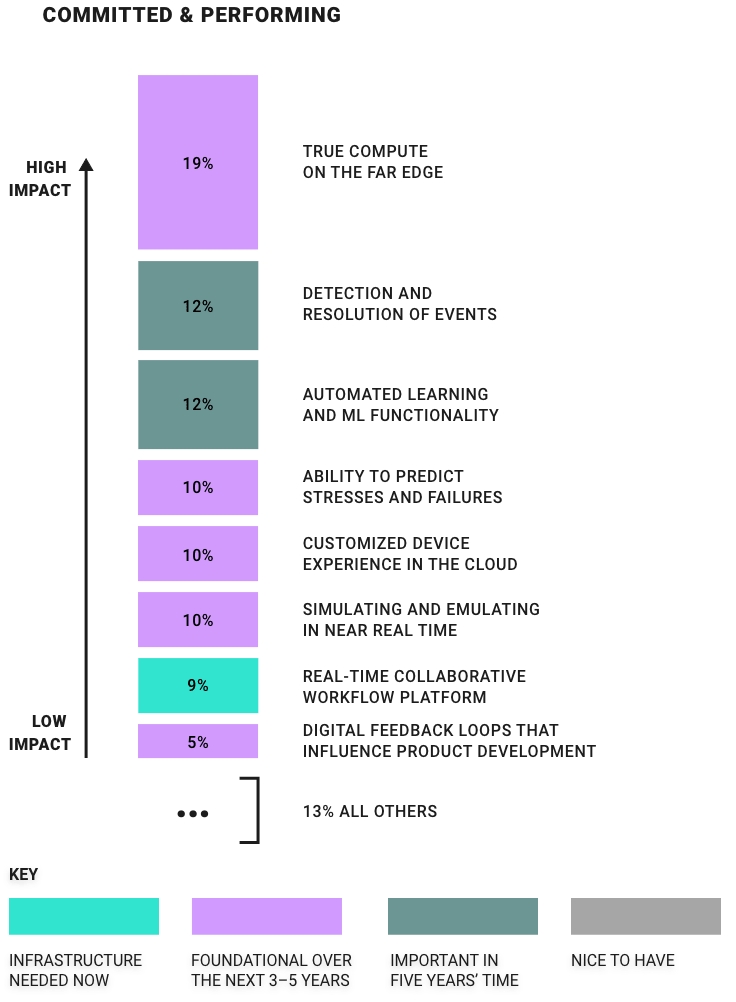

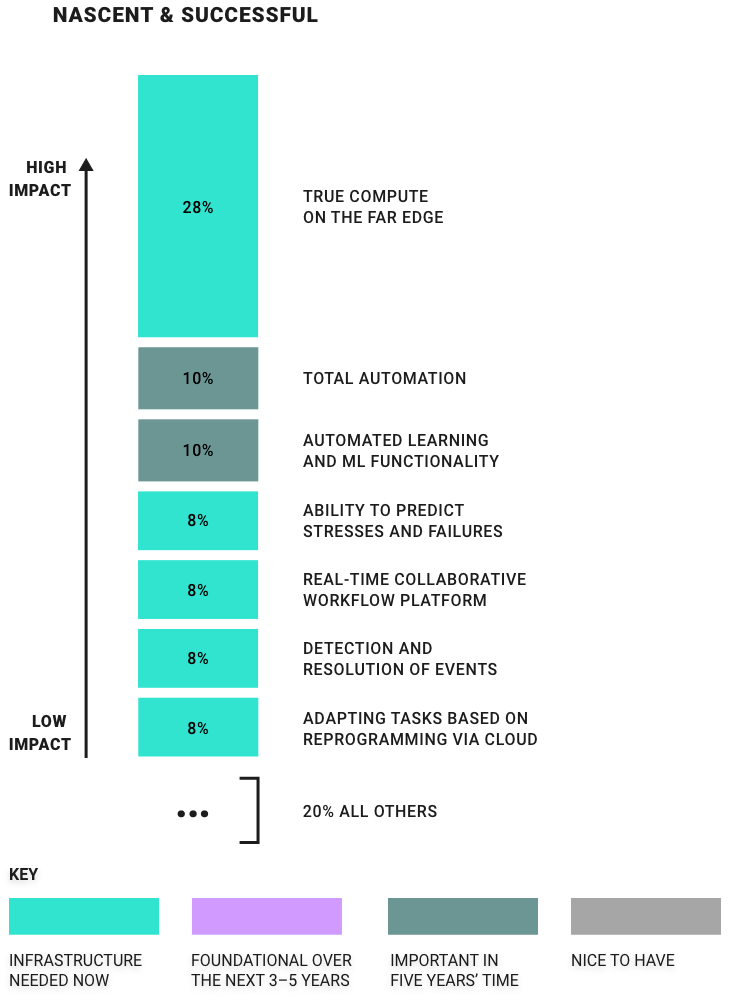

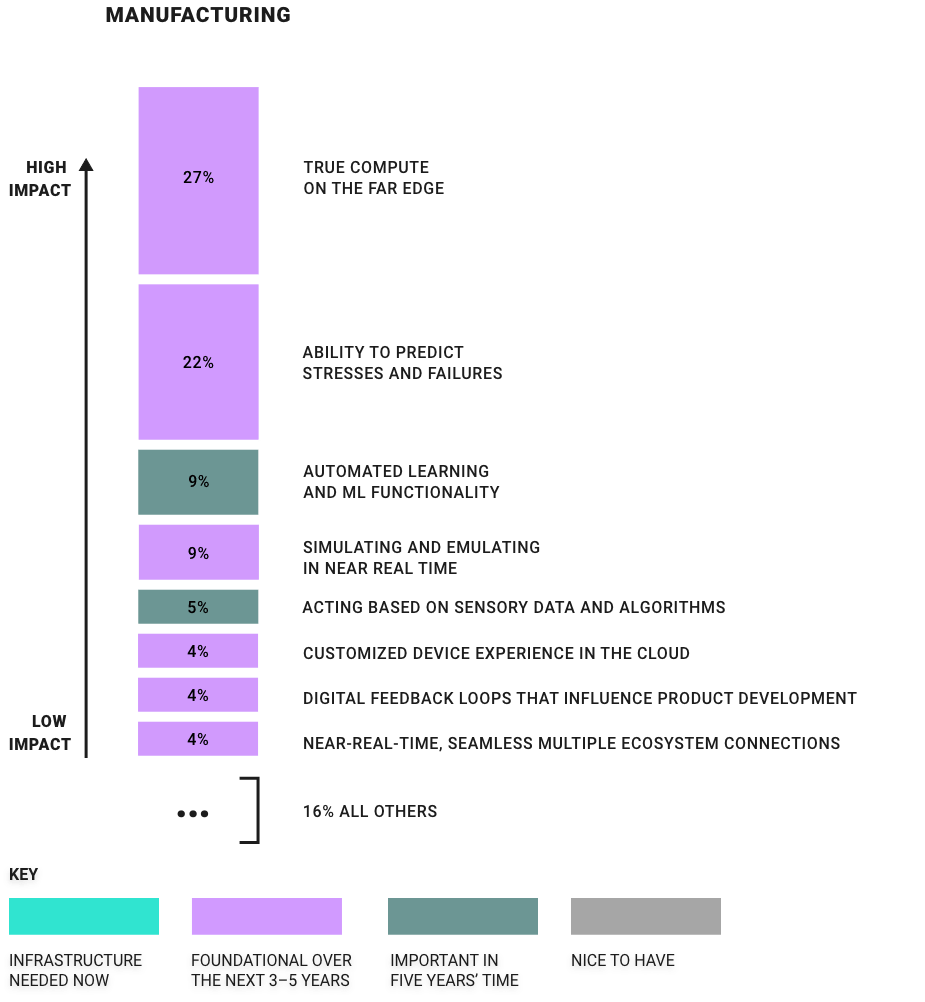

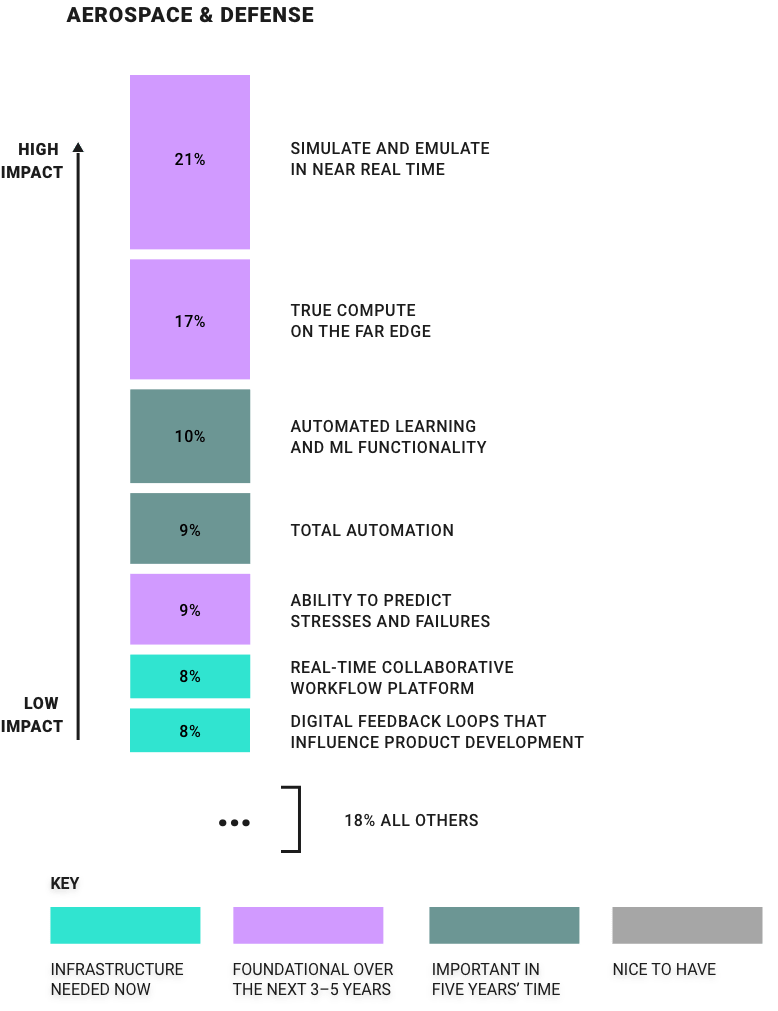

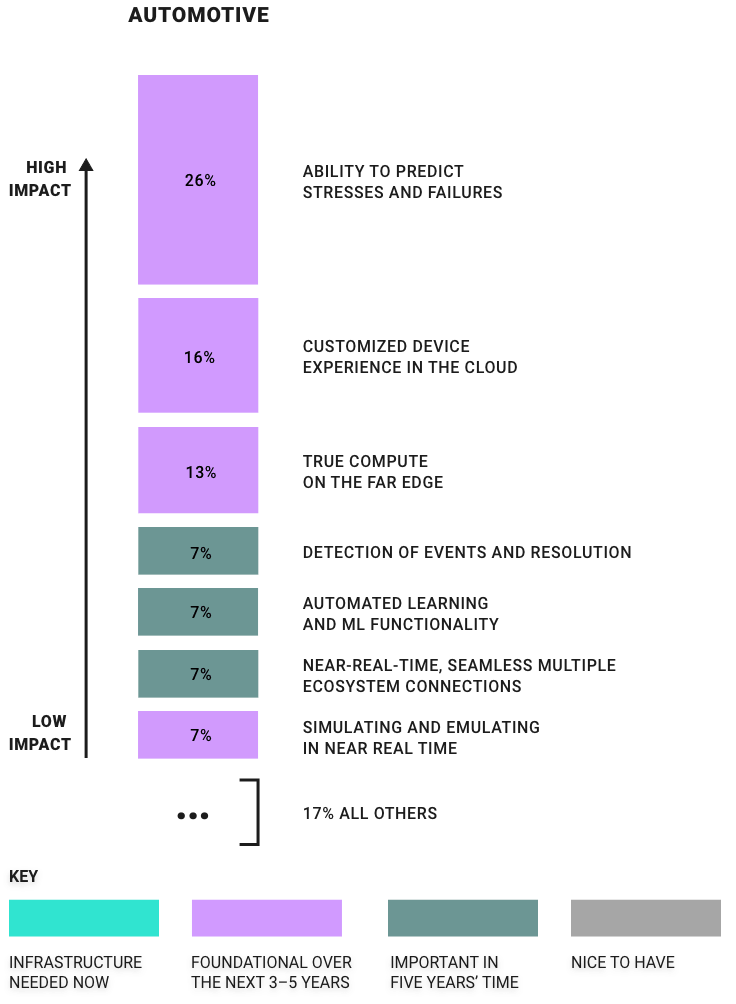

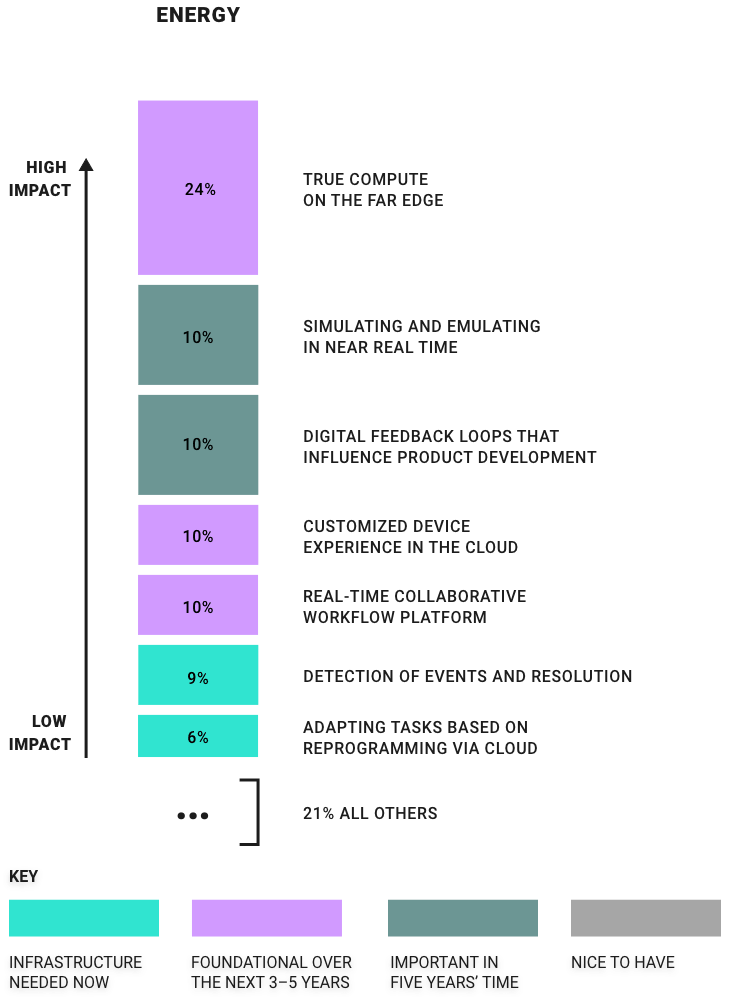

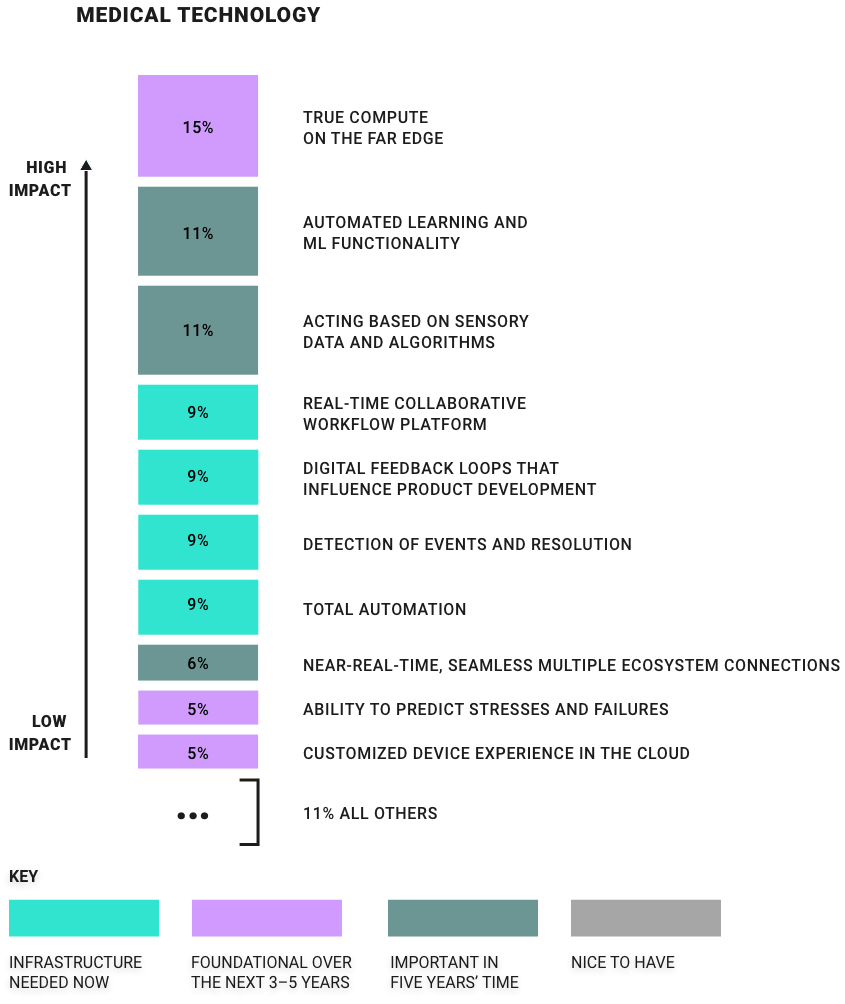

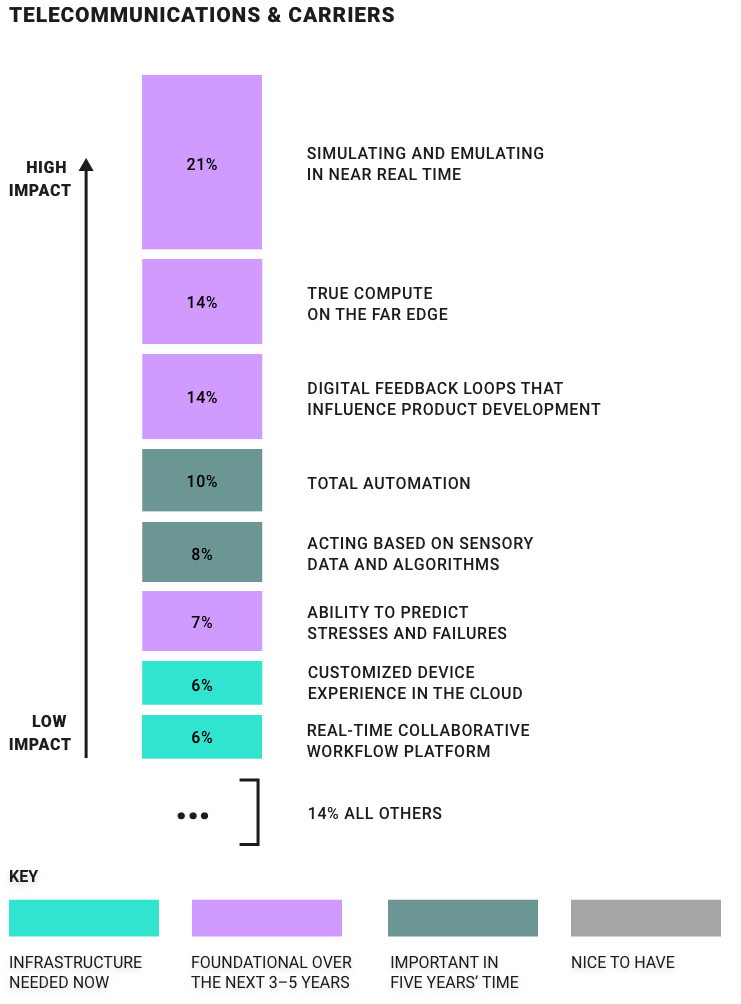

While there are 13 key characteristics of intelligent systems, not all characteristics deliver the same positive impact. Your peers across all sectors told us the far edge is vital for success, especially when 65%+ rely on embedded devices for business success.

These stacks represent the magnitude of impact each intelligent system characteristic has on such systems. The larger the block, the greater the impact. You can view this data for companies grouped by momentum and success, or by specific industry.

EXPLORE MAGNITUDE STACKS

Source: Characteristics of an Intelligent Systems Future, Forbes, 2021

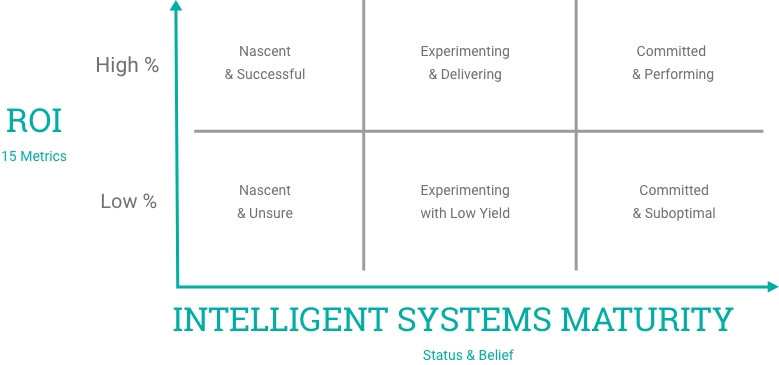

Will you be one of the 16% who are committed and performing?

Think about where your company is on its intelligent systems journey.

For this study, respondents were classified according to a 3x2 segmentation model based on three levels of maturity in the pursuit of intelligent systems and two levels of ROI.

18%

NASCENT WITH SOME SUCCESS

Aspirations are there and the basic characteristics are being built for scale now.

23%

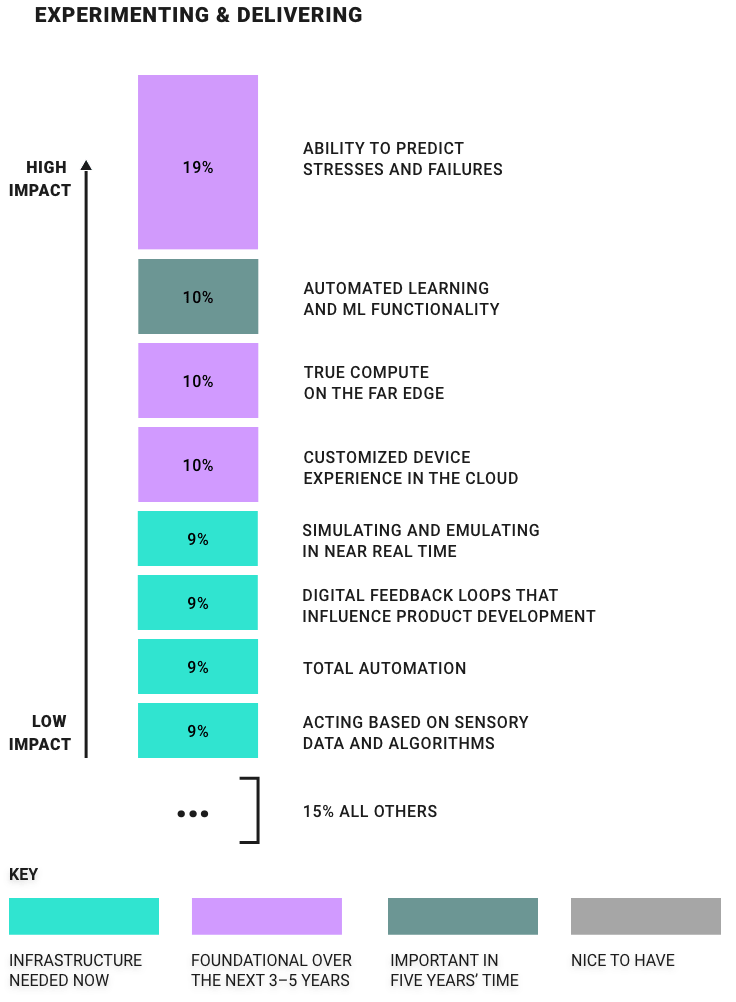

EXPERIMENTING AND DELIVERING

These organizations believe in the idea of digital business models at their core. They need to build from their successes with the far edge and mission-critical capabilities in order to grow.

16%

COMMITTED AND PERFORMING

They hold a deep belief in the teslafication of their business: They beat their peers by 4 to 1 in the maturity of their intelligent systems characteristics implementation.

11%

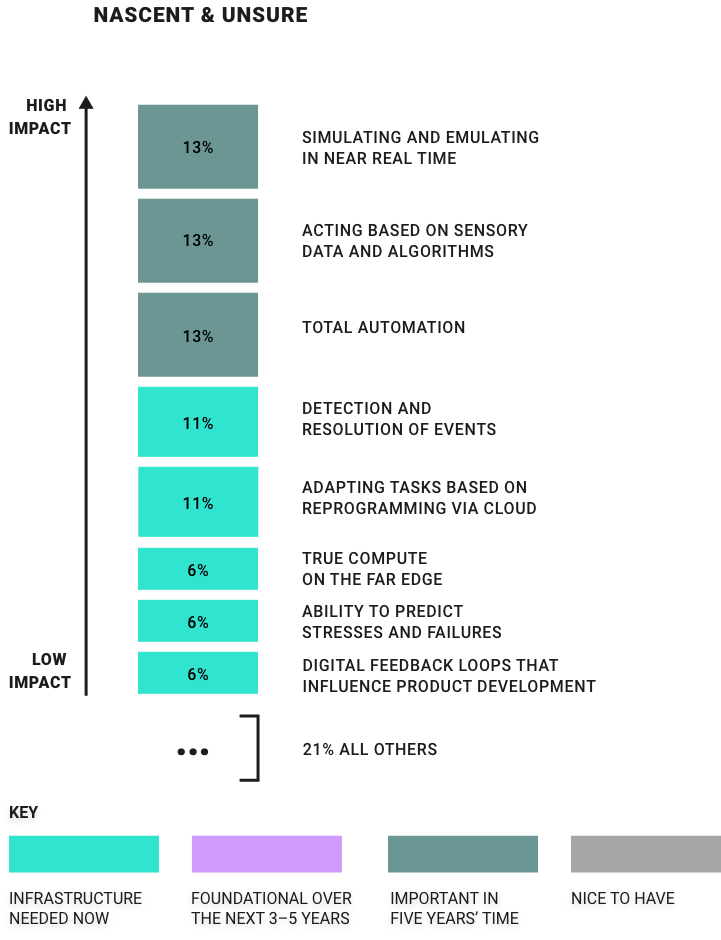

NASCENT AND UNSURE

They do not really believe in the meta trends and so lack vision and motivation.

22%

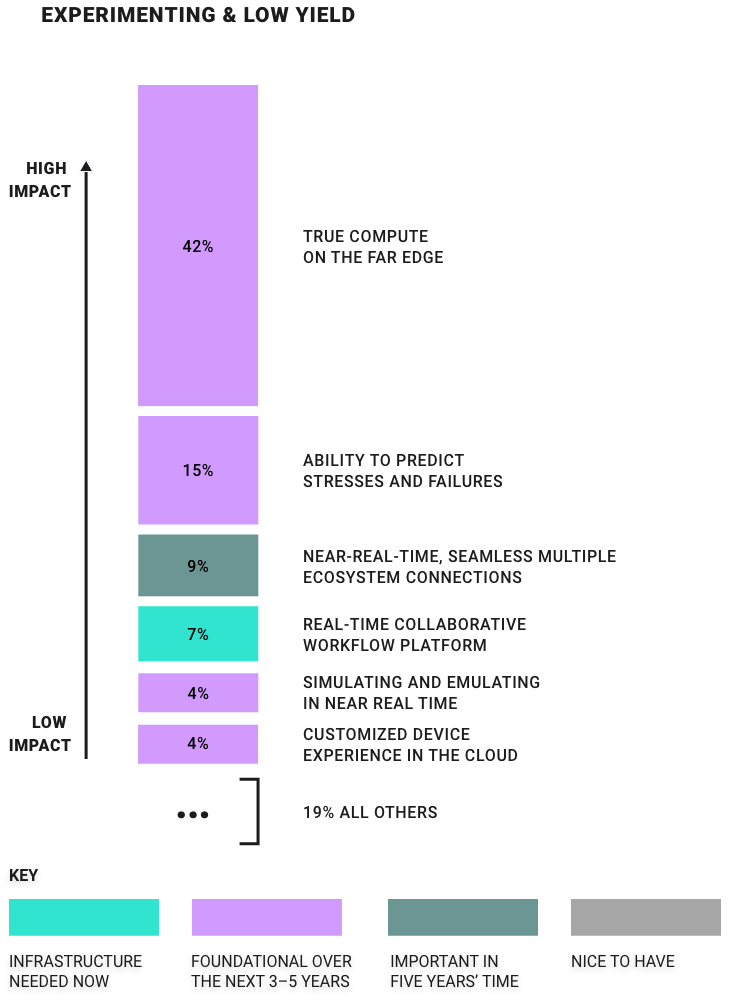

EXPERIMENTING WITH LOW YIELD

Not fully “in” on anything, but they get the bigger idea. They just don’t see the returns yet.

10%

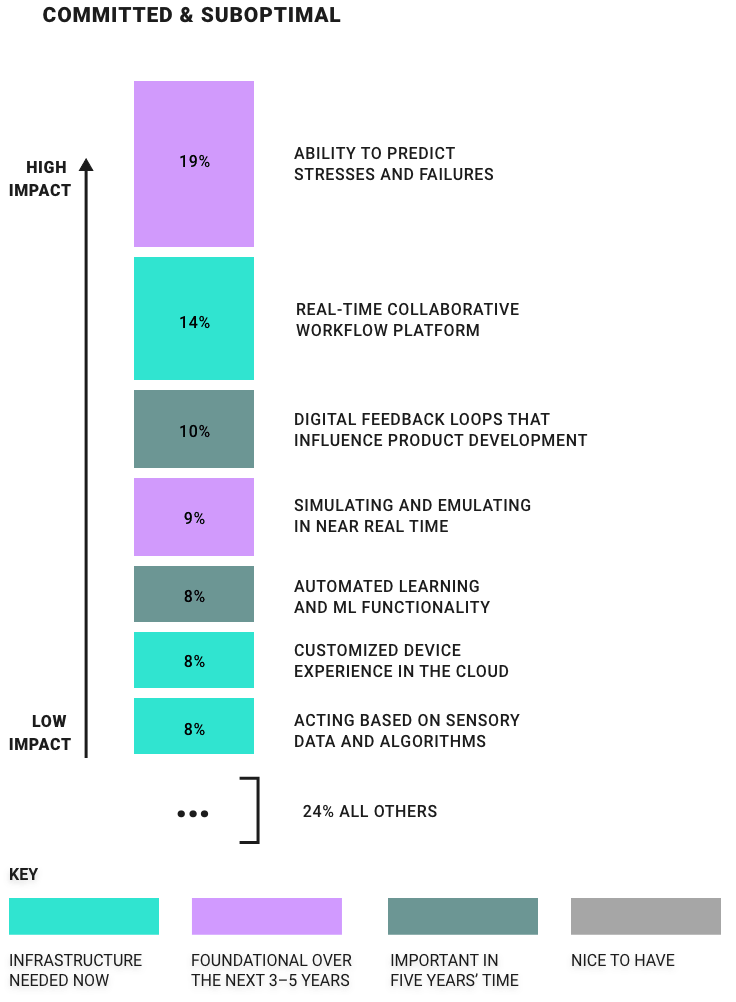

COMMITTED AND SUBOPTIMAL

They believe in a data-driven future but have too narrow a process vision that limits potential returns.

The Engine of the Intelligent Edge

Today’s edge applications require intelligence, precision, responsiveness within milliseconds or microseconds, and flawless around-the-clock performance without human intervention. The real-time operating systems (RTOSes) we have relied on in the past are not necessarily equipped to manage these sophisticated functions on the edge. What is the future of the RTOS?

Start Plotting Your Intelligent Systems Journey

Download “Plotting Your intelligent Systems Journey,” a free 30-page report developed in partnership by Wind River and Forbes.

Our research is based on more than 200 points of comparison across companies building and deploying intelligent systems.

This report shows:

- How your peers are thinking about the barriers to and drivers for adoption of intelligent systems

- What factors would accelerate the adoption of intelligent systems in your sector

- The relative importance of all intelligent systems characteristics, to help you prioritize your investments

- How your peers see the roles and importance of 5G, AI, ML, and cybersecurity in their decision-making

- The key components for the mission-critical success of intelligent systems

- What the future of embedded devices and solutions looks like in an intelligent systems world

- Where digital feedback loops are crucial for success

- What the key metrics for success are

- Where your peers see extensive value for intelligent systems in addressing wider societal issues

Industry 5 - Outlook: Accelerate with Smart Manufacturing Ecosystems

Unlocking the Business Value of Industry 4.0: Part 5

The pandemic of 2020 has led to digital acceleration. “We’ve seen two years’ worth of digital transformation in two months,” said Microsoft CEO Satya Nadella during a quarterly earnings call in the spring of 2020.23

“The disruption and economic hardship caused by the ongoing pandemic have increased the urgency to accelerate smart manufacturing initiatives for future competitiveness,” according to Deloitte.24 In a recent CEO poll by the Manufacturers Alliance for Productivity and Innovation (MAPI), 85% of leaders expected investment in smart factories to rise by June 2021.25

To combat the pandemic, manufacturers installed computer vision systems to enable virtual plant tours for customers, added wearable devices for line workers to signal when they were crossing into a coworker’s six-foot personal space zone, and added collaborative robots (cobots) to augment their workforces, according to Deloitte. Caterpillar’s sales of autonomous technology for mining operations grew at a double-digit percentage in 2020 compared with the year before, according to Reuters.26 Oil companies have been relying on edge computing solutions at well sites so that engineers can steer the drill bits from their offices or, increasingly, their homes.

But the pandemic is also creating a gap between the leaders in smart manufacturing and the rest of the field. Sixty-two percent of manufacturers surveyed in July 2020 are moving ahead with their smart manufacturing investments, allocating even more to such initiatives than they did in 2019.27 However, 38% of manufacturers paused their smart factory investments as they assessed the impact of the economic conditions caused by COVID-19, according to Deloitte.

Deloitte stresses the importance of forming an ecosystem of solution providers to successfully accelerate smart manufacturing initiatives. Given the complexity of Industry 4.0, most manufacturers do not have capabilities in all areas. Ecosystems of state-of-the art solution providers can support a more rapid transition to adaptive manufacturing. The difference between having relationships with partners and vendors and having an ecosystem is that the ecosystem approach requires deliberate coordination among and between various parties. And, as in a biological ecosystem, all players may share the same fate.

The Deloitte and MAPI smart manufacturing ecosystem research identifies eight major use cases for a production ecosystem and the number of manufacturers currently operationalizing them. The study reveals that while 68% of manufacturers surveyed connect with a production ecosystem, each use case is currently operationalized by between just a fifth and a third of manufacturers surveyed. A deeper look at survey data reveals that companies that had external partners were operational, on average, across 31% of the use cases they were implementing, compared with just 15% for those that start with in-house development, according to Deloitte.

Verizon tapped into an ecosystem to initiate the world’s first completely virtualized 5G data session — from the network core to the radio access network (RAN) and the edge of the network. Its ecosystem partners included Samsung, Intel, and Wind River. Samsung’s 5G virtualized RAN hardware and radio units were integrated with Wind River platform and container-based middleware as well as the Intel Xeon Scalable processor, field-programmable gate array (FPGA) acceleration card, Ethernet network adapter, and software reference architecture.28

Bill Stone, VP of technology development and planning at Verizon, described a mature, collaborative, and innovative ecosystem when he discussed the partnership in a phone interview with SDxCentral: “It was a combination of selecting the best-in-class vendors that supplied the necessary components, having them develop to our requirements, then bringing them together in the lab environment to conduct integration testing, bringing that into our own Verizon lab environment, and then moving into field tests, all of which came together for the main production into the live network.”29

The Deloitte and MAPI study lists the top five partners contributing the most value to manufacturers’ ecosystems, starting with IT software vendors, Industry 4.0 technology providers, operation technology vendors, physical automation/robotics vendors, and professional services firms.

Manufacturers with an ecosystem approach to smart manufacturing are about twice as likely to see an increase in their pace of introducing new digital products and services in the market, an expansion of innovation capacity in the company, acceleration in digital maturity of the company, and a reduction in operational costs through greater efficiencies.30

Eight Use Cases for a Production Ecosystem

and the Share of Manufacturers Operationalizing Them

Source: Deloitte/MAPI31