automotive solutions page

What Really Matters to Executives Building Intelligent Systems?

According to 56% of automotive leaders, the most important intelligent systems characteristic is using simulations or emulations during development and operation to increase productivity and reduce time-to-market.

The next most important characteristics are protecting data and guarding against cyberattacks (46%) and being able to sense and react based on goal-based algorithms (44%). Find out what else we learned from 500 of your peers.

Schedule a DigitalWorkshop for Your Team

Schedule Now“

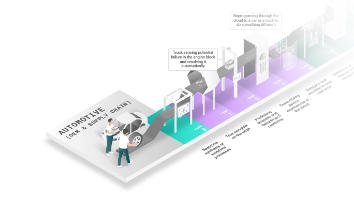

“Connected networks of vehicles, cities, devices, and roads will support completely autonomous driving.” 1

On the Edge in

Autonomous Vehicles

For the future of full autonomous driving, Frost & Sullivan predicts the technology will mature and be accepted for trucks and off-highway vehicles first, then in passenger vehicles. Already today, there are many examples of robotic trucks being tested on highways in the U.S., Europe, Asia and elsewhere. Nonetheless, Frost & Sullivan expects we will have to wait until 2035 before “connected networks of vehicles, cities, devices, and roads will support completely autonomous driving.”1 Read the Article.

1 Deenadayalan, Mugundhan, “Autonomous Driving Will Convert Drivers to Pilots,” Frost & Sullivan, September 13, 2019

Leading Auto Companies Trust Wind River

Resources

Intelligent Systems JourneyDownload the report

timing and impact

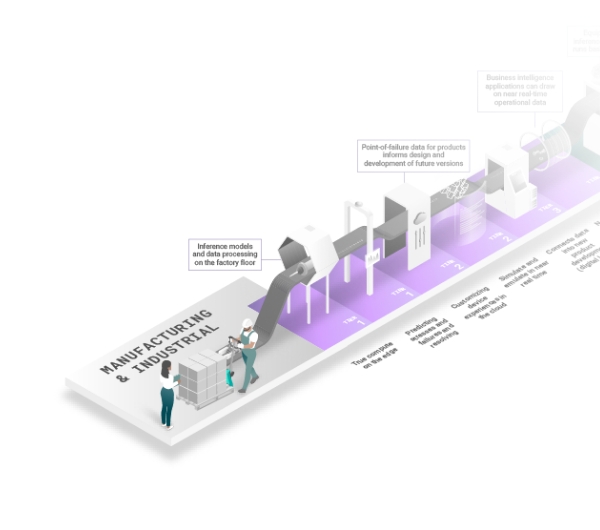

Power Connected Intelligent Systems

Changes the Paradigm